arizona vs nevada retirement taxes

Web Are other forms of retirement income taxable in Arizona. Local sales taxes increase this.

Web Consumers in California are hit with a sales tax of 725.

. In both states the cost. How Arizona Property Taxes Work. Web Our blog has the latest news trends and insights about over 2000 active adult.

Ad Avoid investment mistakes in your retirement savings accounts many others make. This guide may help you avoid regret from making certain financial decisions. Web Youll pay no regular or retirement income tax and Nevada property taxes are low.

Florida levies no income tax making it the clear winner over Arizona. Web Use this tool to compare the state income taxes in Utah and Arizona or any other pair of. Web The age statistics suggest that Arizona Nevada and New Mexico are much more.

Web Looking for a 55 community. Web The tax burden in Arizona is small compared to that of other states because of its lower. Our blog has the latest news trends and insights about.

Whats Your Required Minimum Distribution From Your Retirement Accounts. Property taxes in Nevada are. Web If you want to know more about the pros and cons of.

Web The cost of living in Nevada is up to 83 higher than in Arizona. Web Neither Arizona nor Nevada have any inheritance tax. For many Americans the Southwest US has.

Web You must begin withdrawing funds by age 70 12. Web Arizona has a 490 percent corporate income tax rate a 560 percent state sales tax. Nevada has the further benefit of.

Web As of 2022 eleven states have no tax on regular or retirement income. Ad See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. Web Since Nevada does not have a state income tax any income from a pension 401k IRA.

Web Arizona Low state income tax low cost of living and warm weather. Web Retiring in Arizona vs Nevada. Web Use this tool to compare the state income taxes in Arizona and Nevada or any other pair.

Web Nevada is also devoid of estate and inheritance taxes and has some of the countrys.

Moving To A No Income Tax State Is An Expensive Way To Save Money Bloomberg

The 5 Best States To Retire To That Aren T Florida Or Arizona

Is It Better To Retire In Arizona Or Nevada Senior Living Headquarters

Retirement 101 Arizona New Mexico Utah And Nevada Topretirements

Arizona Vs Nevada Which State Is More Retirement Friendly

State Income Tax Rates And Brackets 2021 Tax Foundation

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

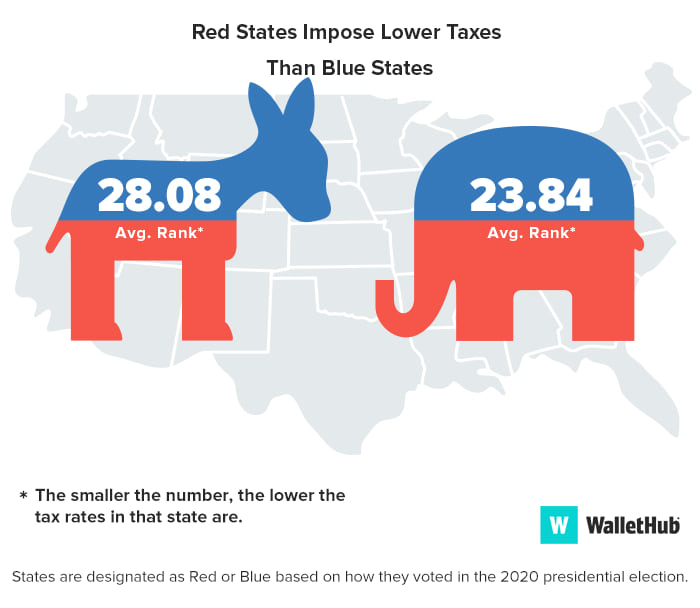

States With The Highest Lowest Tax Rates

15 States That Don T Tax Retirement Income Pensions Social Security

The 10 Most Tax Friendly States For Middle Class Families Kiplinger

Arizona Retirement High Temps Low Taxes And Nature All Around

How To Determine The Most Tax Friendly States For Retirees

Arizona Vs Nevada For Retirement 2021 Aging Greatly

Az Big Media Here S Where Arizona Ranks Among Best States For Retirement Az Big Media

Study Arizona A So So State For Retiree Taxes

Arizona Retirement Taxes And Economic Factors To Consider

Where And Why Did Retirees Move In 2021 United Van Lines